Omnicom and Publicis Call the Whole Thing Off

Earlier this month, Omnicom and Publicis revealed that they were walking away from their proposed $35 billion "merger of equals" that they had originally announced to great fan-fare last summer as they claimed that greater scale would allow them to better face a changing media landscape and the likes of Google. The news of the cancelled deal (which was a "cancellation of equals" if you will in that neither will pay the $500M breakup fee) was a major story in the worlds of finance and media, as the combination would have toppled WPP as the world's largest advertising agency holding company.

Earlier this month, Omnicom and Publicis revealed that they were walking away from their proposed $35 billion "merger of equals" that they had originally announced to great fan-fare last summer as they claimed that greater scale would allow them to better face a changing media landscape and the likes of Google. The news of the cancelled deal (which was a "cancellation of equals" if you will in that neither will pay the $500M breakup fee) was a major story in the worlds of finance and media, as the combination would have toppled WPP as the world's largest advertising agency holding company.

However, this result did not come as a complete surprise, given that the deal had faced an onslaught of regulatory hurdles and that the companies' most recent earnings calls did little to reassure investors, with one analyst saying the two CEOs were "not singing from the same song book." Indeed, it was ultimately a lack of agreement and consensus at the highest levels that proved a bridge too far for this transatlantic deal to cross.

Some of the aforementioned regulatory hurdles were certainly posing problems, with anti-trust clearance in China and tax approvals in Europe being two of major government blessings that had yet to be secured. There were also technical elements that were proving sticking points, such as which firm would be the acquirer from an accounting standpoint.

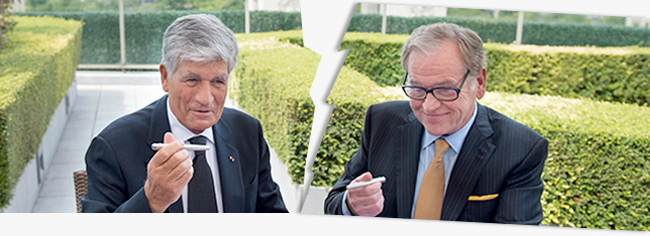

The real stumbling block here though came on a human level. The two CEOs, Omincom's John Wren and Publicis' Marcus Levy (who were slated to share power for the first 30 months with Wren taking the reins thereafter) could not agree on who would fill key roles, such as those of CFO and General Counsel. Both wanted their respective firms' executives in those positions, and Levy feeling that Omnicom was in fact, if not in name, taking over Publicis - an outcome he felt obligated to prevent.

This lack of certainty at the top trickled down, with senior executives at both companies distracted by the merger and how it would impact them. The obvious example of this would be individuals who were unsure whether there would still be a place for them at the combined firm. A more intricate example involves the technical accounting issues described above. While who would be the acquirer from an accounting perspective may seem like minutiae, it certainly mattered to managers whose evaluations and compensation depend on things like amortization and depreciation charges, the allocation of which would be impacted by that decision.

Many of these issues could have, and should have, been dealt with before the announcement of the merger. While it can't be known whether greater advanced planning could have produced a different result, it certainly would have reduced the uncertainty in the interim.

Following the announcement that the deal was off, both companies quickly began communicating with their stakeholders in an attempt to highlight their attractive strategies moving forward, with each hosting a separate conference call the next day.

While both focused on the future, it was reflections on what had happened that provided the most memorable sound bites as Levy described it as being "much better to not go to the church rather than going to the judge. So we are divorcing before getting married." While a social media savvy Wren said that if he "had to summarize [what caused the break-up] in a tweet it would be, corporate culture, complexity and time. And I would still have 100 characters left."

While this advertising mega merger might be off, that doesn't mean deal making in the space won't continue apace. The holding companies still face an evolving environment, and they do so armed with healthy balance sheets. In the immediate term, this cash may be deployed to traditional uses such as buybacks, tuck-in acquisitions aimed adding capabilities (such as digital expertise). The types of partnerships both firms recently struck in the social media space, with Publicis announcing "a sprawling partnership" with Facebook and Omnicom signing a $230 million deal with Twitter (apparently John Wren's affinity for the micro blogging platform extends further than witty soundbites), makes one think that larger deals may be on the horizon. Some have speculated that that Interpublic, which is no stranger to takeover rumors, could find itself in the crosshairs as well. Stay tuned for further news on Madison Avenue mergers and deals. ![]()